It's a Team's Life

Trick to buying fuel cheap

This topic confuses many and even if you get into a conversation you will begin to wonder if you get it...

Questions came up after my blog entitled “The cheapest fuel is not always the least expensive fuelâ€. In order to ensure the most advantageous fuel and tax cost, you have to consider the IFTA and how this affects the net price of fuel purchased for a commercial motor vehicle.

The IFTA definition of a commercial motor vehicle is any power unit that transports people or property and has a registered GVW of 26,001 pounds or greater; or, has three or more axles.

What is IFTA?

IFTA is an agreement between the lower 48 states and the Canadian provinces. This program was created to simplify how we pay road use taxes to each State. Whether or not you buy fuel in a particular State, you must still pay road use taxes.

Simply stated, IFTA works as a "pay now or pay later" system. As commercial motor vehicles (CMVs) buy fuel, any fuel taxes paid to the States is credited to that Carrier’s account. At the end of the fiscal quarter, the carrier completes their fuel tax report, listing all miles traveled and all gallons purchased in all participating jurisdictions. Then the average fuel mileage is applied to the miles traveled to determine the tax liability to each jurisdiction. A few of the States have road use tax formulas that differ from the norm. Carriers that pay taxes through IFTA will keep track of the miles driven in each jurisdiction by each of its company owned or leased trucks. The leased truck owner will then be charged or refunded any differences as appropriate.

Understanding the IFTA process will help you keep your tax obligations under control.

Example:

Purchase 100 gallons of fuel in State, “A†which has a 25-cent fuel tax.

Your account is credited with $25.00 tax paid.

Your truck averages 10 miles per gallon so you may drive 1000 miles in State “A†without an additional fuel tax liability.

If you only drove 500 miles in State “Aâ€, you would have a credit of $12.50 in your IFTA fuel tax account.

You enter State â€B†which also has a 25-cent fuel tax and you travel 500 miles. Since you have $12.50 in your account, you will not have to buy fuel in State “Bâ€

Keeping money in your pocket when buying fuel is an easy way

of lowering your operating costs.

While

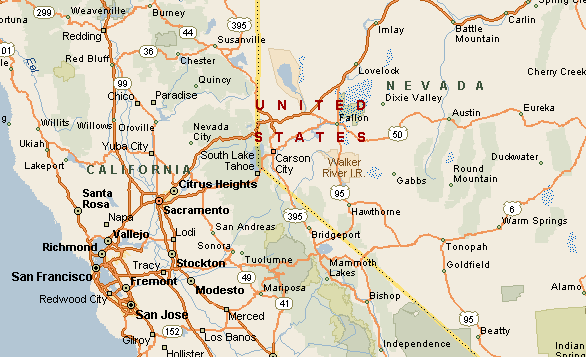

the idea can look over whelming having a copy of the IFTA chart really

simplifies this process.

Bob & Linda Caffee

TeamCaffee

Saint Louis MO

Expediters since January 2005

Expediting isn't just trucking, it's a lifestyle;

Expediting isn't just a lifestyle, it's an adventure;

Expediting isn't just an adventure, it's a job;

Expediting isn't just a job, it's a business.