It's a Team's Life

Financial Crimes Enforcement Network

Back in 2019 a bill was introduced into the US Congress by Rep Carolyn B. Maloney (D-NY) it was named the Corporate Transparency Act of 2019 (which is now law). This Act (now law) was being introduced that it “addresses the disclosure of corporate ownership and the prevention of money laundering and the financing of terrorism.” So, you are saying what does this have to do with trucking? This Act which was implemented in 2021 affects small business who in not so many terms had employees. In trucking that means owner-operators and fleet owners. If you created a Limited Liability Corporation (LLC), some Corporations (Corp), Limited Liability Partnership (LLP) and filed with your states Secretary of State.

This Law created the Financial Crimes Enforcement Network (FinCEN). They are charged with collecting the data from the owners of LLC, Corp, LLP which includes the following:

- Full legal name;

- Any trade name or “doing business as” name;

- Complete current U.S. address;

- Jurisdiction of formation (including State1 or Tribal jurisdiction for a domestic reporting company);

- For a foreign reporting company only, State or Tribal jurisdiction of first registration; and IRS Taxpayer Identification Number (TIN), including an Employer Identification Number (EIN) (or, if a foreign reporting company has not been issued a TIN, the reporting company’s foreign tax identification number and the name of the issuing jurisdiction).

- List all individual that have ownership stake greater than 25%. This is considered substantial control of the company.

For each beneficial owner and each company applicant required to be reported:

- Full legal name;

- Date of birth;

- Complete current address;

- Unique identifying number and issuing jurisdiction from one of the following non-expired documents: (1) U.S. passport; (2) identification document issued by a State, local government, or Indian Tribe issued for the purpose of identifying the individual; (3) State-issued driver’s license; or (4) if none of (1)–(3) are available, a foreign passport; and

- An image of the document from which the unique identifying number was obtained.

So, if you fall into the who has to provide this information you can do so at this website: Beneficial Ownership Information (BOI) Reporting

On the site they also have a help section. It does a pretty good job explaining and answering questions about the process. One thing we do not like is all the links are PDF files that download you cannot view them online. Here is the link to the help page: Ownership Information (BOI) Reporting Help and Resources

The government will collect a fee from you for filing. That fee is $85.00. From what we read it looks like a one-time fee when you do the initial filing.

As part of this Law you are required to provide mailing address updates if you move. They way they know what that new address is. We did not see any fees required to make the change.

When do you need to file by? You have until the end of 2024 unless you created one of the above listed entities on or after January 01, 2024 you have 30 days to comply. But, the FinCEN is proposing extending that to 90 days. Non-compliance can result in high penalties and possible imprisonment. The escalating fines range from $500 to $10,000 per violation and jail time of up to two years. We even read that those fines can be applied to each day you are in non-compliance.

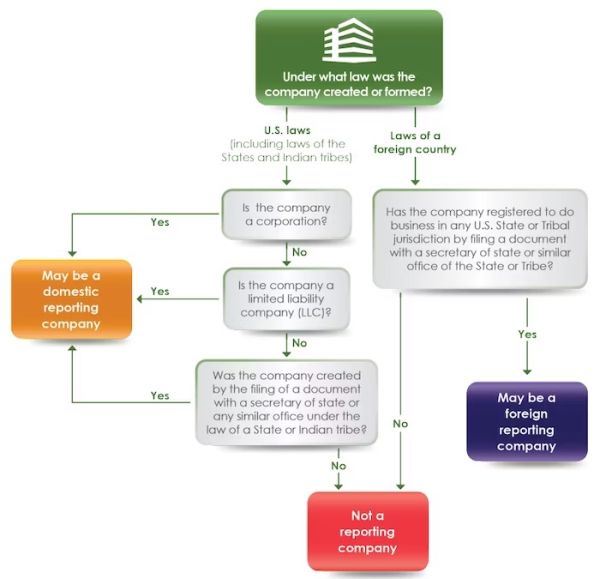

FinCEN has provided a flowchart to help you figure out if you need to file or not. See the chart below:

That is about it. We are sure we might have missed something and will put out new blogs with updates or if we learn anything new.

Sandy & Stephen

We’re Burning Daylight - “Wil Anderson” (The Cowboys) John Wayne