Fuel for Thought

Fuel and Fuel Taxes

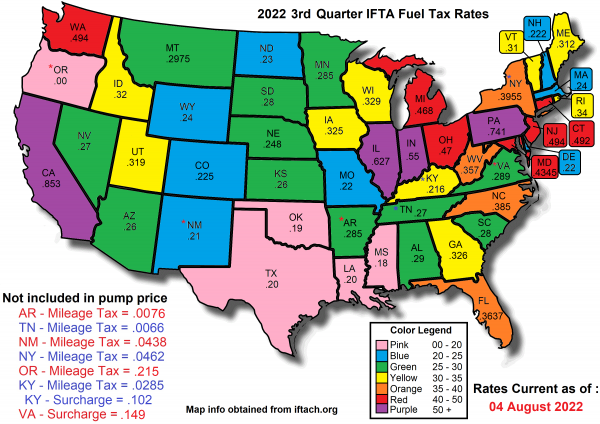

Fuel taxes are definitely an ever changing expense for the owner operators. Where you choose to fuel can have a significant impact on your fuel costs. Currently, there are only twelve U.S. states that have the same fuel tax rate, and of these twelve, there are six different rates. Currently Texas and Louisiana have a rate of .20, while Missouri and Delaware have the same .22 tax rate, Wyoming and Massachusetts are both .24, Arizona and Kansas both have a rate of .26, Nevada and Tennessee are at a rate of .27 and coming in at .28 are South Carolina and South Dakota. As for the other thirty-six states, they all have different IFTA tax rates from all the others. For those who are wondering, Alaska and Hawaii are not included in IFTA taxes. You are doing your business a disservice if you are not buying your fuel for the lowest net price.

It is no secret that fuel prices have skyrocketed recently. Even with the more recent slight declines in prices, the price of fuel remains elevated.

If you follow fuel tax rates, you can save some of your hard earned dollars by getting your fuel for the lowest NET price (pump price minus fuel tax rate equals net price).

Whether you pay the fuel taxes at the pump or pay them later, it will be the same amount based on your miles traveled in a state, your miles per gallon and the tax rate of that state. Spend your money wisely, buy fuel at the lowest net price.

California and Pennsylvania have the highest fuel rates in the country, but that doesn’t necessarily mean you should avoid fueling there. Conversely, Oregon at .00 and Louisiana at .18 are the states with the lowest IFTA tax rates and that alone also does not make them automatically less expensive per gallon. You have to watch the tax rates and do the math to find your best net fuel prices.

Below is a current IFTA fuel tax map that you can use to easily see the fuel tax rates in each state.

Fuel wisely.

See you down the road,

Greg