In The News

3 Trends to Watch with Electric Vehicles Amid the Pandemic

One of my big takeaways from covering the NTEA Work Truck Show in Indianapolis the first week in March was that trucks and vans that serve the expedited trucking industry appeared to be headed toward an all-electric future.

Ford unveiled its plans for a battery-powered Transit van, expected to be available some time in 2022. And several medium- and heavy-duty truck OEMs touted their upcoming electrified models.

But then the coronavirus spread across the globe and caused most of the U.S. economy—including all automotive plants—to shut down for over two months.

So, what’s the COVID-19 fallout for electric vehicles? Will market demand for EVs take a hit? Will the OEMs put their all-electric plans on hold?

Here are three EV trends to watch.

Trend #1: Battery costs

Today, we have cheap gas amid a pandemic.

And, historically, cheap gas has put the brakes on demand for EVs.

After all, why pay a premium for an electric vehicle if gas (and diesel) prices are so low that it could take too long to recoup your investment in electric with fuel-cost savings?

But the “cheap gas vs. EV demand” correlation doesn’t appear to be as dependable today.

Why?

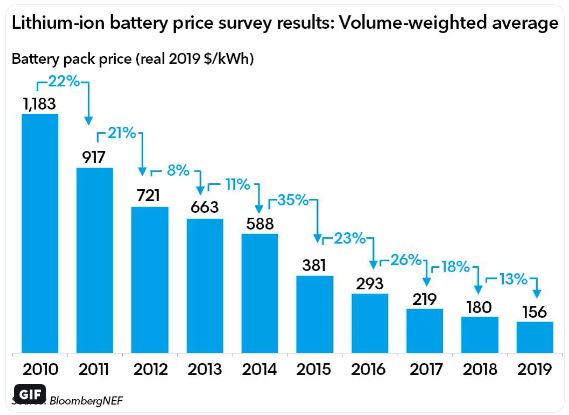

Well, take a look at the latest forecast from BloombergNEF (see chart) that shows battery prices, which were above $1,100 per kilowatt-hour in 2010, have fallen 87% to $156/kWh in 2019.

Photo Credit: U.S. Department of Energy

And that trend is expected to continue with average prices falling to $100/kWh by 2023.

What this means is that as battery costs continue to drop, they’re pushing EVs closer and closer to price parity with their internal combustion engine counterparts, making low oil prices less of a factor on EV demand.

Trend #2: Electricity vs. Gas Prices

As we just talked about. Gas prices are at historic lows.

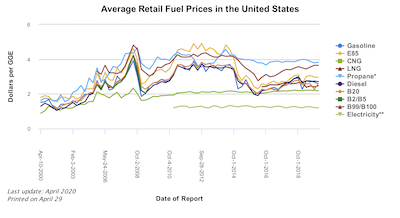

But take a look at the latest fuel price chart from the U.S. Department of Energy.

Photo Credit: U.S. Department of Energy

Notice the electricity “fuel” price line in light green, which is relatively flat towards the bottom of the pricing chart, compared to the roller-coaster volatility of most of the other fuels, including gasoline and diesel.

The industry experts I’ve spoken with expect that electricity prices will remain flat at about a dollar per gallon of gasoline-equivalent, while gas prices will eventually swing back up, which will widen the cost advantage for electricity as a transportation fuel—and, thus, potentially contribute to stronger demand for EVs.

Trend #3: OEM Commitment

In the past year, most automakers have announced big investments in EVs, with new models expected to launch in the next few years.

Then came COVID-19, with plant shutdowns and auto sales plummeting by 50% in April.

So, what’s the pandemic’s impact on OEM commitments to electrification?

First, it has led to product delays.

Ford said that some of this year's product launches, including the Mustang Mach-E electric crossover introduced earlier this year, will be delayed, depending on how long its operations are disrupted.

Rivian, which received a several hundred-million-dollar investment from Ford to develop joint EV models, has pushed the production of its upcoming electric pickup and SUVs into the first half of 2021.

And startup, Lordstown Motors, has pushed the launch of its electric pickup from this December to January 2021.

Yet, based on these recent headlines, the OEMs appear to remain committed to their EV product roadmaps, despite COVID-19:

- COVID-19 Isn’t Derailing GM’s EV Commitment (WardsAuto.com)

- Ford Goes Big on Electrification–Showcases Eco-Friendly Approach that Will Extend to All Models Across Full Line-Up (Ford)

- Lordstown Motors Moves Forward with Motor Production Line Amid COVID-19 Outbreak

Most auto plants in the U.S. have just started reopening May 18. And, that week, there were already reports of at least a couple plant shutdowns for a few hours at a time to disinfect the facilities after positive COVID cases were reported.

So, watch this space for any new developments that might arise.