Dollars & Sense

October 2013 Syleconomics - It was a good month for trucking!

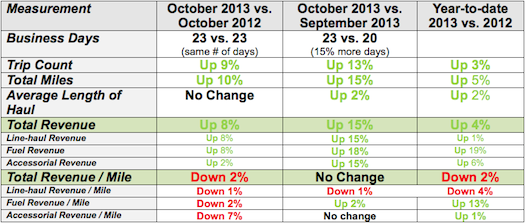

October 2013 vs. October 2012: October 2013 and October 2012 have the same number of business days, so there is no need to adjust the year over year figures. There are a few statements about these numbers.

First, the year over year numbers show a healthy 8-10% growth for October compared to the same month last year.

Second, there are two events that need to be discussed that could have had an (offsetting) effect on these numbers.

In October, 2012 Hurricane Sandy hit the Northeast U.S. coast around October 26 that caused major disruptions to freight patterns in that area. This event could have negatively affected the 2012 numbers.

In October 2013, the US government shut down for about 18 days (September 30 to October17) that could have negatively affected the 2013 numbers.

Since both these events would have dampened demand, we will assume they “cancel each other outâ€.

So, all in all, October 13 shows a very good growth bump over October 12. Line-haul rates continue to show some rebound and starting to push back to levels experienced in the past few years. Capacity numbers are showing a relative stability but we have yet to reach 2007 levels, as such, there should still be good upward pressure on rates as we head into the typically busier pre-Christmas season. See charts below for more information.

Good news—this is the 5th month in a row where we see year-over-year revenue growth and volume. We are finally seeing some decent year-to-date 2013 over 2012 growth after stagnant or no growth for the first half of the year.

October 2013 versus September 2013: October 2013 had three more (15 percent more) business days compared to September 2013, so the nominal increase shown in the tables below would indicate that October was “as busy, but not busier†than September after we adjust for the 15% more business days. September is usually a busier month since it is the “end of a quarterâ€, so the October numbers coming in (adjusted for business days) as similar to September can be seen as good news. The first few days of November show a relatively strong continuation of the October numbers.

Rate per mile is still a bit concerning considering the strong business volumes and muted capacity numbers.

The

year-to-date figures show that business volumes are running a bit above last year.

Due to the stronger past several months (June — October) business volumes and revenues are now tracking at or above 2012 numbers, but rates are still slightly behind last year—which appears to be a common theme.

Capacity is continues to lag and has still not reached 2007 levels. Again, we are finally seeing rates start to creep back to the 2011 and 2012 levels.

Truck Searches and Load Postings: These numbers have retracted a bit in the last 30-40 days, down from the peaks we saw in September.

Below, is a breakdown of the metrics: (Note: To be included in the data analysis, companies had to be on our system for all reporting periods)

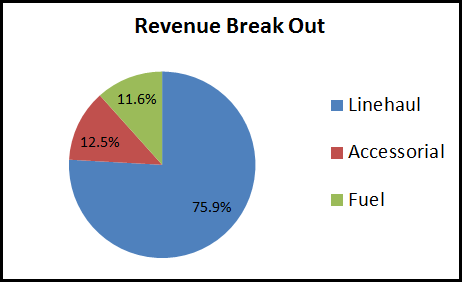

Breakout of Revenue by Type:

In the above table, we show changes in TOTAL revenue and then the changes in the components of total revenue (line-haul, fuel and accessorial). Below, is the breakout by percentage of total revenue:

Line-haul revenue represents 75.9% of the total revenue

Fuel revenue represents 12.5% of the total revenue

Accessorial revenue represents 11.6% of the total revenue

Why are companies outsourcing to the cloud to gain efficiencies?

I visited a prospective customer recently to demonstrate how our software could generate more revenue for their business. After demonstrating our software, he made a comment I often hear:

“Where were you a few years ago when I bought “XYZ†dispatch software?â€

His dilemma: He had purchased a client-server Transportation Management Software (TMS) package four years ago for a significant amount of money. He had to buy a server, server software, database software, TMS software and other components. Then he had to spend for specialist to install and configure the hardware and maintain it going forward. Every time XYZ provided an upgrade, he would pay for upgrade services. Every time there was a problem, it cost them money to get it fixed. Every time they wanted a change to the software to address his changing business model, it cost him “lots of money†to get it modified, and even if he paid the money, the modifications were often delivered very late, and non-functional. They had spent hundreds of thousands of dollars and thousands of people hours getting the software package working and then maintaining it. Often when they applied the software “fixesâ€, other parts of their application would fail or users would complain that it became more difficult to use. It is now four years later and he is again faced with the expense of upgrading his hardware and software platforms since his installed base is obsolete. He is even contemplating adding another expensive technology headcount to his staff to manage this technology platform for him. The technology is becoming an expensive part of his cost of doing business.

All he wants to do is run a trucking company, not be a technology expert.

When I explained to him how quickly I can convert his operation to our TMS, he was amazed. Since we are cloud based, we install, maintain, support and upgrade the hardware, operating system software, database software and supporting software. We provide all the updates to the software on a regular basis. The technology is available anywhere he has internet access.

All he has to do is run his trucking business. Sylectus takes care of the rest of the technology issues. Sylectus becomes his technology department.

I also explained that our recent deployment of Android and iPhone mobile application (Sylectus Mobile) for the driver would significantly improve the productivity of his drivers and operations staff without being tied to a long term, expensive telematics contract.

Furthermore, the way we have integrated other members using our software (Virtual Fleet), it became apparent that our software was actually a revenue generator, not a cost center.

Sylectus has been doing this for 12 years. However, it has only been over the past few years where industry is realizing the power of cloud technologies like Sylectus.

Here are some quotes about Cloud technologies:

“The cloud is the end of client/server computing as we know it. CIOs who resist cloud models fear losing control of IT, but that is the wrong approach.â€

Mark Forman, former US Government CIO (click here to read the entire article)

“

The basis of cloud computing is not really new. What is new is the breadth and scale of the offerings combined with the speed and the level of adoption in the commercial and government sectors. With Dell and Verizon beginning to restructure their businesses around this new phenomenon, you know it is headed for wide-scale adoption by businesses globally.â€

Joseph Puglisi, co-founder—The Cloud Computing Consortium (click here to read the entire article)

In the past six months, several brand name technology behemoths made “bet the farm†decisions to re align their businesses and thrive in the post client-server world. Why? Because cloud computing and innovative, cost-effective mobile computers are no longer “early adopter†options; they have reached critical mass.

All transportation business owners should be asking themselves how they can use TMS cloud technology as a

revenue generator.

The transportation industry is perfectly positioned to benefit from cloud technology. Sylectus has proven that small to medium sized businesses have realized significant gains by using our integrated technology. Not only is Sylectus a top-notch TMS, it comes with a built-in, integrated, list of customers (other carriers excess freight) and capacity (other carriers excess trucks).

Case in point #1. I was at the Expedite Expo this past July in Wilmington, Ohio. Many Sylectus customers had booths at the Expo recruiting drivers. Many Sylectus customers were keeping track of what was going on in their business on their mobile devices (iPads, etc.). Why? Because they could. One customer in particular was taking orders, dispatching, tracking his drivers (who were using our Sylectus Mobile Android integrated devices) and basically running his business on his iPad while at his booth. Why? Because he could. He truly epitomized the “mobile office†or “mobile business†moniker. His efficiency, productivity, customer service, etc. were all significantly better than had he been using a client server based TMS.

Case in point #2. Sylectus has a customer who has family in Europe. At 9:00 p.m. in North America, he forwards his phones to an office in Europe where his family then run the business via Sylectus on the internet. This continues until 6:00 a.m. in North America when he and his staff return to their North American operation and phones are transferred back. He can provide 24/7 customer service regardless of the physical location of his staff. Why? Because he can.

If you are still not convinced, Sylectus welcomes you to talk to any of our AlliancePro subscribers and ask them to compare the Sylectus TMS software solution to any other TMS solution on the market. Our AlliancePro subscribers are our best sales people.

Before making that decision about XYZ dispatch software, let us show you how the Sylectus technology can help grow your business.

About Sylectus

Sylectus is trucking’s most powerful network. Born in the new, cloud-based economy, it’s built on one simple idea … leverage the resources of your competitors to achieve extraordinary results for

your customers and for

your company.

Sylectus is more than Transportation Management Software. It’s a

web-based, protected, wealth creation network for managing in the New Trucking Economy. Designed exclusively for

progressive trucking companies,

Sylectus enables them to bypass the investment and time continuum to grow fast

NOW.