I received the following E-mail from Panther concerning 1099s for tax year 2016:

Dear Professional Independent Contractor,

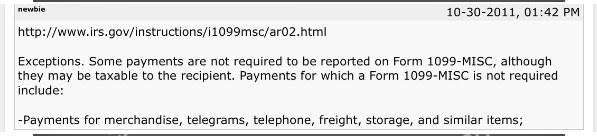

As April 15 is rapidly approaching, we wanted to reach out to you regarding your IRS Form 1099 information. Due to new Federal laws, Panther is not required to send you an IRS Form 1099 unless you have received payments outside of compensation earned from freight hauling services.

Panther Premium Logistics has attached to this email a "2016 Tax Helper Detail Report". Panther is providing this report as a courtesy to assist you in your tax preparation for 2016.

The "2016 Tax Helper Detail Report" is NOT a 1099 form. Panther is only providing this to assist you in reviewing your revenues and expenses derived from Panther this year. Panther will not be issuing 1099's for compensation related to freight hauling services as payments made for the transportation of goods are excepted from 1099 reporting. The "Total Amount" line on the attached "2016 Tax Helper Detail Report" will equal the amount of total payments from Panther. Please consult with your tax advisor.

Is anyone else aware of this change? This E-mail included a link to my very own compensation for 2016. It was much more detailed than a 1099. It stated my year gross plus all of the deductions, ie: insurance, QC etc. Previous years I had to go through it week by week and add it up. For years I was after Panther to include a "year to date" total on my weekly settlement statement, to no avail. Now I have it! Well not a weekly year to date, but at least an end of year tally!

Are other carriers going this route?

Dear Professional Independent Contractor,

As April 15 is rapidly approaching, we wanted to reach out to you regarding your IRS Form 1099 information. Due to new Federal laws, Panther is not required to send you an IRS Form 1099 unless you have received payments outside of compensation earned from freight hauling services.

Panther Premium Logistics has attached to this email a "2016 Tax Helper Detail Report". Panther is providing this report as a courtesy to assist you in your tax preparation for 2016.

The "2016 Tax Helper Detail Report" is NOT a 1099 form. Panther is only providing this to assist you in reviewing your revenues and expenses derived from Panther this year. Panther will not be issuing 1099's for compensation related to freight hauling services as payments made for the transportation of goods are excepted from 1099 reporting. The "Total Amount" line on the attached "2016 Tax Helper Detail Report" will equal the amount of total payments from Panther. Please consult with your tax advisor.

Is anyone else aware of this change? This E-mail included a link to my very own compensation for 2016. It was much more detailed than a 1099. It stated my year gross plus all of the deductions, ie: insurance, QC etc. Previous years I had to go through it week by week and add it up. For years I was after Panther to include a "year to date" total on my weekly settlement statement, to no avail. Now I have it! Well not a weekly year to date, but at least an end of year tally!

Are other carriers going this route?